- Home

- »

- Communications Infrastructure

- »

-

ROADM WSS Component Market Size Report, 2030GVR Report cover

![ROADM WSS Component Market Size, Share & Trends Report]()

ROADM WSS Component Market Size, Share & Trends Analysis Report By Type, By Node (Two-node, Multi-node), By Application (Long Haul, Metro), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-670-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

The global ROADM WSS component market size was valued at USD 870.0 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.2% from 2024 to 2030. The increasing data traffic, widespread adoption of 5G networks, need for data center interconnectivity, and rising demand for network virtualization are some factors highlighting the importance of these solutions. ROADM WSS stands for Reconfigurable Optical Add/Drop Multiplexer Wavelength Selective Switch. It allows for the precise selection and management of individual wavelengths in an optical fiber, providing network operators with precise control over data transmission. The steadily increasing data transmission volumes across the world require large network bandwidth. ROADM WSS facilitates network flexibility and efficiency, which accounts for its heightened demand, leading to market growth.

The exponential increase in data consumption driven by cloud computing, video streaming, extensive use of social media platforms, and IoT applications has necessitated the presence of high-capacity, efficient, and flexible optical networks. For instance, reports state that about 5.35 billion consumers, that is, around 66% of the global population today has internet access. Rising digital transformation and smartphone adoption by consumers in developing countries have fueled the demand for better internet connectivity. ROADM WSS components are essential for efficiently managing this expanding data traffic, leading to steady market expansion.

As data centers expand and interconnect, the requirement for high-speed, low-latency optical networks becomes paramount. ROADM WSS components play a pivotal role in optimizing data center connectivity. Additionally, the widespread adoption of 5G technology demands robust and agile infrastructure. ROADM WSS solutions offer the required flexibility to support the dynamic nature of 5G networks. Ongoing research and innovations in WSS technology, such as the development of more compact and cost-effective components, are preferred by consumers, which help in driving market expansion.

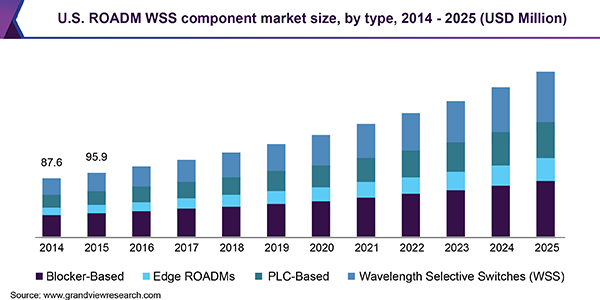

Type Insights

The Wavelength Selective Switches (WSS) segment dominated the global market with a revenue share of 44.2% in 2023. WSS components are the fundamental building blocks for controlling and routing optical signals based on their wavelengths. This precise control is essential for optimizing network performance and resource utilization. Moreover, continuous innovations in WSS technology, such as increased port density, improved switching speeds, and reduced power consumption have solidified their position as the preferred choice for network operators, leading to dominance of this segment in the market.

The PLC-based segment is expected to register the fastest CAGR of 13.8% over the forecast period. PLC technology is considered to be a scalable and cost-efficient manufacturing process, resulting in lower component prices compared to traditional technologies. This economic advantage has stimulated wider adoption and accelerated market penetration of the components. Furthermore, PLC-based components offer greater design flexibility, enabling the creation of customized solutions to meet specific network requirements. This extensive adaptability has contributed to their widespread adoption across various network architectures and topologies.

Node Insights

The multi-node segment held the highest market revenue share of 67.1% in 2023. Multi-node ROADM configurations offer greater flexibility in managing and controlling wavelength flow across multiple network nodes. This attribute is crucial in accommodating the dynamic and evolving demands of modern communication networks. Additionally, the segment is well-positioned to support emerging network trends such as data center interconnectivity, 5G deployment, and the proliferation of cloud services, which require high-capacity, flexible, and scalable optical infrastructure.

The two-node segment is expected to grow at a significant growth rate over the forecast period. The two-node configuration offers core network backbone architecture. For instance, optical networks rely on a hub-and-spoke topology, where core network nodes are interconnected through point-to-point links. This architecture requires the deployment of two-node ROADM systems to efficiently manage optical signal routing and wavelength assignment between these core network locations. This attribute, along with lower costs of deployment, presents two-node configuration as a cost-effective alternative to multi-node configuration, accounting for its notable share in this market.

Application Insights

The metro segment led the market, accounting for 57.1% of the revenue share in 2023. Metro networks are characterized by high network density and a substantial number of data centers, enterprises, and residential areas. This requires frequent network reconfigurations to accommodate evolving traffic patterns and service demands. ROADM WSS components provide the necessary flexibility to adapt to these dynamic conditions. While the metro segment is characterized by high network density, the shorter distances involved compared to long-haul networks allow for the deployment of more cost-effective ROADM WSS solutions. These factors of flexibility and affordability fuel market growth of this segment.

The long haul segment is expected to witness a significant growth rate during the forecast period. Long-haul networks travel across vast geographical areas and require high-capacity and low-loss optical transmission. ROADM WSS components are instrumental in optimizing wavelength management and network efficiency over these extended distances. As data traffic continues to rise, network operators are compelled to upgrade their long-haul infrastructure, which has helped ensure consistent segment growth.

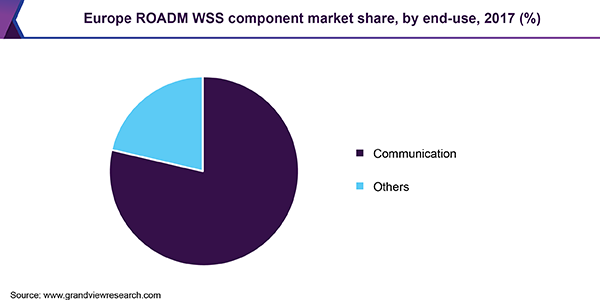

End Use Insights

The communication segment accounted for the highest market share of 77.9% in 2023. The telecommunication sector has played a pivotal role in data transmission globally. Telecommunications companies are increasingly being compelled to adapt to the digital age, driven by growing data usage, a surge in the use of connected devices, and the need for quicker services. To meet these demands, continuous technological upgradation is required. For instance, the demand for 5G technology is rising, and telecom companies are investing significant resources in building the necessary infrastructure.

The other end-uses segment is expected to advance at a faster CAGR during the forecast period. Rapid advancements in technology are leading to new applications for optical networks, such as data center interconnects, metro and access networks, and submarine cable systems. These emerging areas are expected to contribute significantly to the increasing market share of other end-uses of ROADM WSS. Furthermore, specialized applications requiring tailored ROADM WSS components highlight the need for smaller and niche manufacturers in this industry.

Regional Insights

North America held the largest revenue share of 32.6% in the market in 2023. This region has witnessed several technological advancements in the telecommunications sector, fostering a conducive environment for the development and deployment of innovative solutions such as ROADM WSS. These factors are accompanied by a well-established and extensive telecommunications infrastructure, creating a substantial demand for network upgrades and expansions, thereby driving the adoption of ROADM WSS components.

U.S. ROADM WSS Component Market Trends

The U.S. held a dominant share in the regional market in 2023. Several prominent telecommunication equipment manufacturers and service providers such as Cisco Systems, Inc., Agiltron Inc., and AC Photonics, Inc. have their headquarters in the country, which has stimulated the growth of the ROADM WSS component ecosystem. Furthermore, substantial investments in research and development activities in the U.S. have contributed to the development of advanced ROADM WSS technologies and components.

Europe ROADM WSS Component Market Trends

Europe accounted for a considerable market share in 2023. Europe's early and substantial investments in broadband networks and digital infrastructure have created an expanding demand for high-capacity, flexible optical networks. ROADM WSS components are essential enablers for such networks, driving their uptake in the region. Moreover, the stringent regulatory environment and emphasis on data privacy have accelerated the deployment of secure and resilient optical networks. ROADM WSS components play a crucial role in enhancing network security and reliability, thereby contributing to their widespread adoption in Europe.

UK ROADM WSS Component Market Trends

The UK is among the earliest economies where telecommunication infrastructure was established successfully. As a result, the presence of such a mature ecosystem of telecommunications equipment manufacturers, research institutions, and service providers in the country has nurtured a collaborative environment for the development and commercialization of ROADM WSS components. This ecosystem has been instrumental in driving technological advancements and market growth.

Latin America ROADM WSS Component Market Trends

Latin America is expected to register the fastest CAGR of 14.2% from 2024 to 2030. The region is undergoing a swift transition towards digital economies, characterized by increasing internet penetration, urbanization, and the proliferation of data-intensive applications. According to Latin America Digital Transformation Report 2023 published by Atlántico, the region has surpassed China in terms of internet connectivity in the last decade. This surge in digital activity requires robust and scalable telecommunications infrastructure, driving demand for advanced components such as ROADM WSS. Additionally, a cost-competitive environment for telecommunications infrastructure development has attracted investments in network expansion and modernization, driving market growth.

Brazil ROADM WSS Component Market Trends

According to government data in Brazil, internet penetration in 2021 reached over 65.6 million households, which is around 90% of the overall households in the country. Additionally, the increasing adoption of smartphones and other mobile devices has led to a surge in mobile data traffic, demanding efficient and flexible network solutions. ROADM WSS components play a crucial role in enabling internet service providers and mobile network operators in the country to meet the growing bandwidth requirements and improve network performance.

Key Companies & Market Share Insights

Some key companies involved in the ROADM WSS component market include Ciena Corporation, Adtran, and AC Photonics, Inc., among others.

-

Ciena Corporation is a U.S.-based networking systems and software services company. Ciena specializes in creating and selling solutions for telecommunications companies and major cloud providers. Their offerings include hardware, software, and support services to handle and manage voice and data communication across networks. The company offers various equipment for network infrastructure such as the 6500 family of Packet-optical platforms which includes the 6500 D/S-Series, 6500-T Series, and 6500 Reconfigurable Line System (RLS). It further provides Navigator Network Control Suite (NCS) for optimization of multi-layer performance.

-

AC Photonics, Inc. is an American fiber optics product supplier. The company serves different industries such as aerospace, defense, communication, and healthcare through its services in photonic solutions. AC Photonics offers components for Dense Wavelength-Division Multiplexing (DWDM) with channel spacing of 200, 100, and 50 GHz for transmitting signals in many wavelengths through a single optical fiber. In the OADM component segment, AC Photonics offers single and dual-channel OADMs with 100/200 GHz ITU channel spacing.

Key ROADM WSS Component Companies:

The following are the leading companies in the ROADM WSS component market. These companies collectively hold the largest market share and dictate industry trends.

- AC Photonics, Inc.

- Agiltron Inc.

- Cisco Systems, Inc.

- Coherent Corp.

- Fujitsu

- Adtran

- Corning Incorporated

- Ciena Corporation

- Molex

- Lumentum Operations LLC

Recent Developments

-

In March 2024, Adtran announced that it had successfully completed the first-ever trial in Europe for optical transport within a live research network, in partnership with BT Group. This trial leveraged Adtran’s Coherent 100ZR pluggable transceiver, showcasing its high spectral efficiency level and low power consumption. The trial further showcased the transceiver’s capability to allow long-distance transport of 100Gbit/s wavelengths, bringing efficient and scalable solutions.

-

In March 2024, Coherent Corp. introduced a new optical circuit switch that leverages the company’s field-tested and highly reliable Datacenter Lightwave Cross-Connect (DLX) technology. The solution has been optimized for deployment in artificial intelligence data centers.

ROADM WSS Component Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 952.7 million

Revenue Forecast in 2030

USD 1.90 billion

Growth Rate

CAGR of 12.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, node, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

AC Photonics, Inc.; Agiltron Inc.; Cisco Systems, Inc.; Coherent Corp.; Fujitsu; Adtran; Corning Incorporated; Ciena Corporation; Molex; Lumentum Operations LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ROADM WSS Component Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ROADM WSS component market report based on type, node, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blocker-based

-

Edge ROADMs

-

PLC-based

-

Wavelength Selective Switches (WSS)

-

-

Node Outlook (Revenue, USD Million, 2018 - 2030)

-

Two-node

-

Multi-node

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Long Haul

-

Metro

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."